The Impact of the EU Carbon Border Adjustment Mechanism (CBAM) in Smart Manufacturing

01/12/2022

The Impact of the EU Carbon Border Adjustment Mechanism (CBAM) in Smart Manufacturing

What is CBAM?

Anthropogenic carbon emissions are the main cause that has led to a rapid increase of atmosphere temperature, so in order to balance the economic development and climate impact, some countries have set key mechanisms, like an emissions trading system (ETS), to regulate the carbon emitted from organizations. Carbon Border Adjustment Mechanism (CBAM) is a mechanism which puts a carbon “price” on imports of high-carbon-intensity items, and aims to avoid carbon leakage whereby manufacturers move the carbon intensive production process to other countries to green their own production numbers. The first CBAM directive was proposed by the European Commission on 14 Jul. 2021 and was planned to be implemented within a transitional period from 1st Jan. 2023 and officially released on 1st Jan. 2026.

CBAM in the EU will equalize the carbon price between domestic products and imports to prevent carbon leakage and ask importers to submit verified carbon emissions embedded in their goods and surrender the corresponding number of carbon certificates for a carbon price that is not required in the origin country.

After the EU announced they were going to implement CBAM, supply chains in regulated industries were asked to provide all carbon emissions information. Corporates who foresee these trends would then start to build their carbon emissions inventory strategy with the sole purpose of keeping their business competitive. CBAM accelerates and encourages corporate action on investigating their own carbon emissions and planning to de-carbon their own supply chains.

To adapt to the impact of CBAM, corporates need to understand how CBAM works and how the importers and their suppliers carry out their obligations. This article will briefly introduce CBAM below, then share a solution that can help corporates face CBAM to overcome the challenges of de-carbonation.

How CBAM works?

(1) Transitional stage (1st Jan. 2023~31st Dec. 2025): the importers have to submit a CBAM report containing imported items and quantities, direct and indirect embedded carbon emissions of imported goods (tCO2e) as well as the carbon price paid in the origin country for each quarter.

(2) CBAM fully placed stage:When CABM is fully placed, it will work as follows:

i. Importers of the CBAM covered goods should register the national authorities to buy the certificates. The price of certificate will be calculate depending on the weekly average auction price of EU ETS allowances.

ii. Importers must declare “the quantity of goods” and “embedded emissions” in those goods imported by 31st May every year and buy a certificate corresponding to the embedded emissions in the products.

iii. If the importers can provide verified information from third country producers which proves the carbon price has been paid, then the corresponding amount can be deducted in the final bill.

How the importer and suppliers carry out their obligations

- Embedded direct emissions quantifying method

Embedded emissions quantifying methodology could be simplified as: The distributed emissions of imported goods from the production process (tCO2e) + The distributed emissions of the input materials in its process (tCO2e)/Quantity of goods (tons). The distributed emissions of certain items could be calculated as: The carbon intensity of the item (tCO2e/Unit) × quantity of the item (Unit). The carbon intensity could then be derived from default values published by the exporting country, or the EU, or the actual value from the supplier which is verified.

- Verification standards

Corresponding with EU ETS, the verification of CBAM should be conducted following Annexes IV & V of the CBAM proposal and ISO 14064s. A minimum data requirement should be kept for imported goods including the type, the quantity, the country of origin, and the actual emissions or default values, as well as the name and the unique identifier of the importer. If the embedded emissions are carried out from actual emissions, for each type of goods, the identification of installation to produce the goods, contact information of the operator, verified emissions reports, and the specific embedded emissions of the goods should be provided.

- The calculation of the price of the certificate

Importers would be charged on the basis of reported embedded emissions of the imports and a weekly average auction price in EU ETS. If the importers had already applied actual emission reports, it would lead to emission reductions with a lower carbon price tag

Challenges and Impact for Smart Manufactures

With the imminent imposition of carbon tariffs, the carbon emission values of products directly affects their price competitiveness. The CBAM directives encourage corporates to consider the carbon footprint of their products and the impact of the production process. Since the general agreement of global carbon reductions was made, more and more regulations, mechanisms or initiatives are being put in place in different countries with the understanding that stakeholders should be liable for their own emission calculations and the need to build an efficient system following agreed rules and requirements. This entails reporting and making de-carbonation strategies transparent throughout whole supply chain.

Most manufactures have already built monitoring and data collection into their production processes. They manage all materials and operations and keep energy and material wastages to a minimum, but they still need to integrate energy management into their systems. Carbon emission inventory systems will help them better prepare emission reports quickly and make their comprehensive de-carbonation strategies open and transparent.

Since it is complex for manufacturers to understand all the requirements of carbon emission requirements, many manufactures need to organize specialist teams or pay consultants to complete their carbon emission reports to help them pass verification.

Typical difficulties are described below.

(1) Time consuming effort on understanding legal specifications and quantifying carbon emissions.

(2) Difficult to consolidate different systems to build a more efficient estimation and management system.

(3) Inefficient methods of calculating parameters and the preparation of records to meet verification requirements.

(4) Results do not present useful information on emissions.

CBAM Implications and Solutoins

CBAM will apply to steel products imported into the EU (as well as other industrial goods such as iron, aluminum, fertilizers, ammonia and cement). For example, according to the Global Cement organization: From 2027, the 27 member states of the European Union will begin to charge third country-based cement exporters for the CO2 emissions of their products sold inside the bloc. The new Carbon Border Adjustment Mechanism (CBAM) is a lynchpin in the strategy to realize a 55% reduction in EU industries' CO2 emissions between 1990 and 2030.

On the regulatory side, manufacturers are under increasing pressure to meet carbon emission targets set by governments. Investors are also paying greater attention to companies’ environmental, social, and governance (ESG) practices, of which sustainable energy management is an integral part.

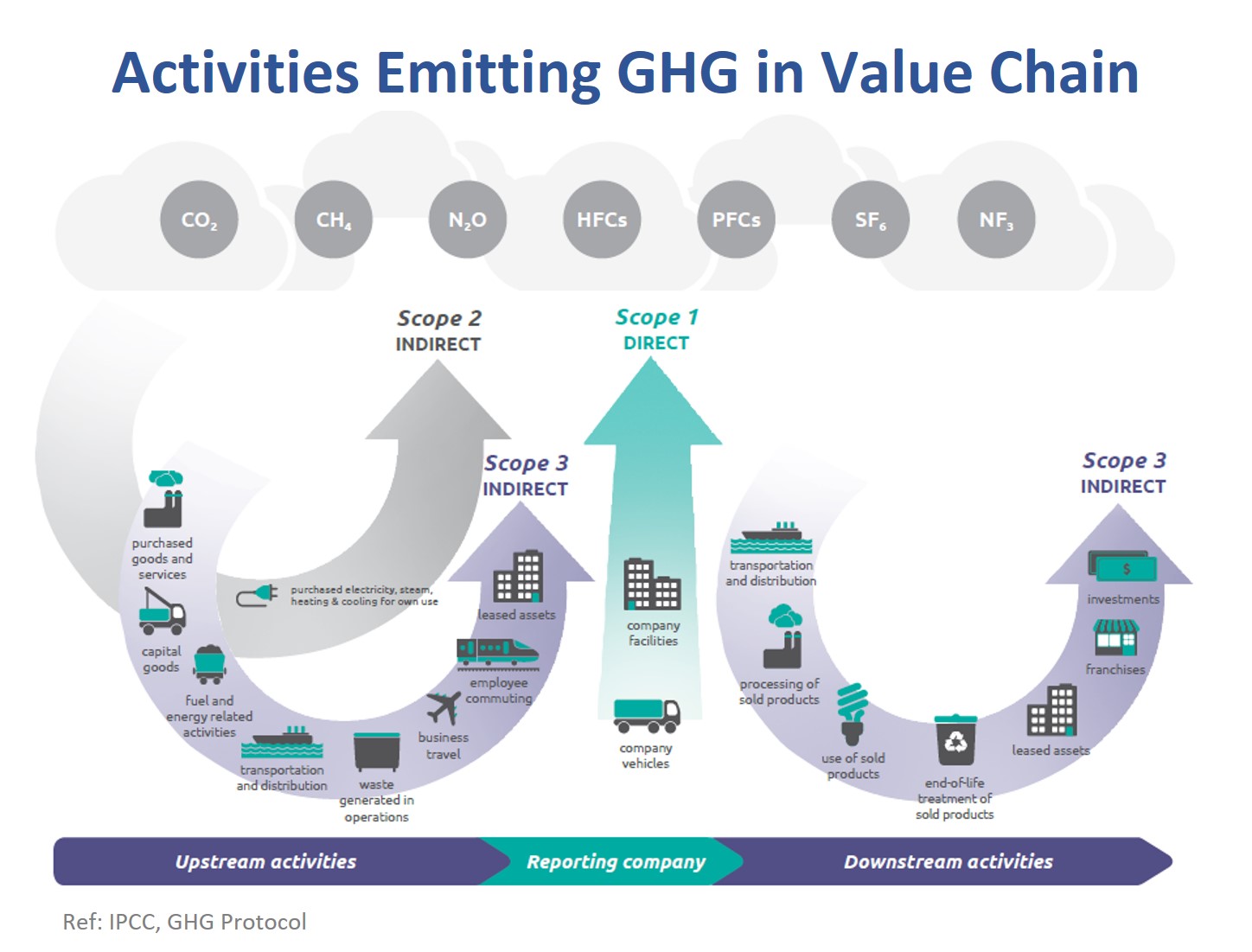

According to the greenhouse gas protocol:

Today, most major companies publicly report their emissions to CDP, an international corporate emissions platform. As sustainability managers know, corporate emissions come from a variety of sources, which are grouped into “scopes.”

Scope 1 = emissions from owned or operated assets (for example, the fumes from the tailpipes of a company’s fleet of vehicles)

Scope 2 = emissions from purchased energy

Scope 3 = emissions from everything else (suppliers, distributors, product use, etc.)

How does Advantech WISE-iFactory help reduce carbon footprint?

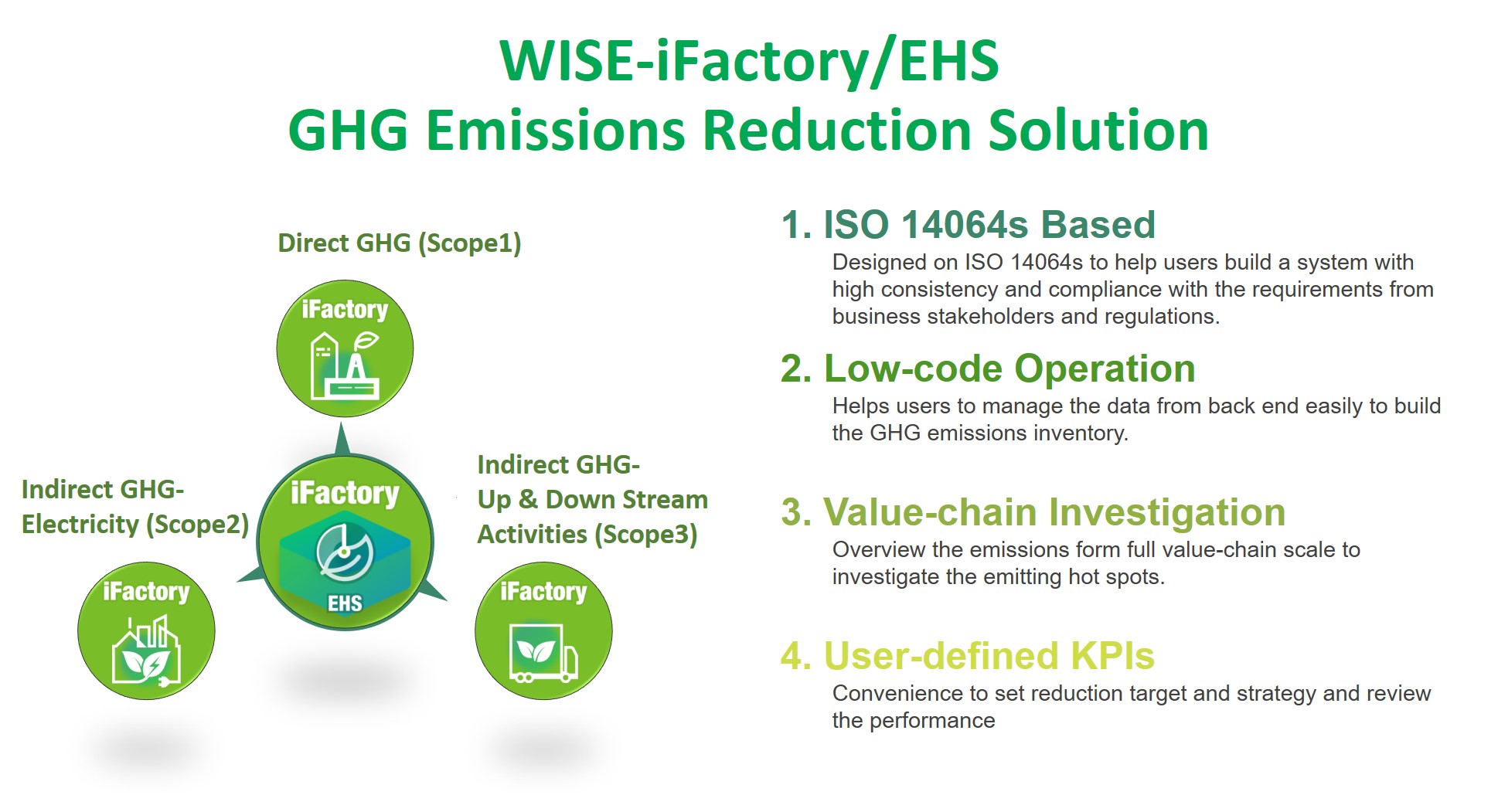

Advantech WISE-iFactory GHS is a powerful solution for those looking to drive sustainable change in reducing carbon emissions and tracking their carbon footprint in a systematic way. Built on robust science and life cycle thinking, sustainability software is ideal for ESG experts, decision-makers and sustainability experts. It’s a fact-based LCA approach that provides the insights you need to make better decisions, empower better choices, and reduce the environmental footprint of products and services.

Following the greenhouse gas protocol, WISE-iFactory focuses on the three Green House Gas (GHG) scopes and can now cover specifications of Scope 1 to Scope 3, including self-emission, carbon emissions generated by purchasing electricity, and upstream and downstream carbon emissions, which can be accounted, recorded and analyzed through our solution.

Other than GHG (scope 1,2,3) management, Advantech WISE-iFactory is powerful on energy management via AIoT technology from the edge to the cloud. Data from edge will be immediately transmitted to the data center so actions can quickly be taken if there are any incidents.

Contatuc us

Send your inquiry to iFactory team to explore more solutions

Becoming our partner

Join iFactory Partner Program and let's work together for success

/MIC-770_Side _S20190325104539.jpg)

/WebAccess.b20180426164007.jpg)

-25/WISE-EdgeLink_image20220614093754.png)