The purpose of risk management is to protect and enhance the value of the company, to have a structured and systematic assessment of the existing and potential risks that may be faced, and to make timely corresponding decisions in line with the company's operating goals and strategies, thereby contributing to continuous improvement. As a global industry leader, Advantech has always paid attention to and promoted major strategies and operational risk management.

Advantech has formulated risk management policy and business continuity plan to prepare for possible business interruption risks, goodwill or various emerging risks, to define operation procedures when risks occur to minimize the possible impact and impact when risks occur, and to achieve follow-up correction and management.

In addition, in response to various related risks, Advantech strives to provide transparent and timely message delivery and communication to stakeholders who may be affected.

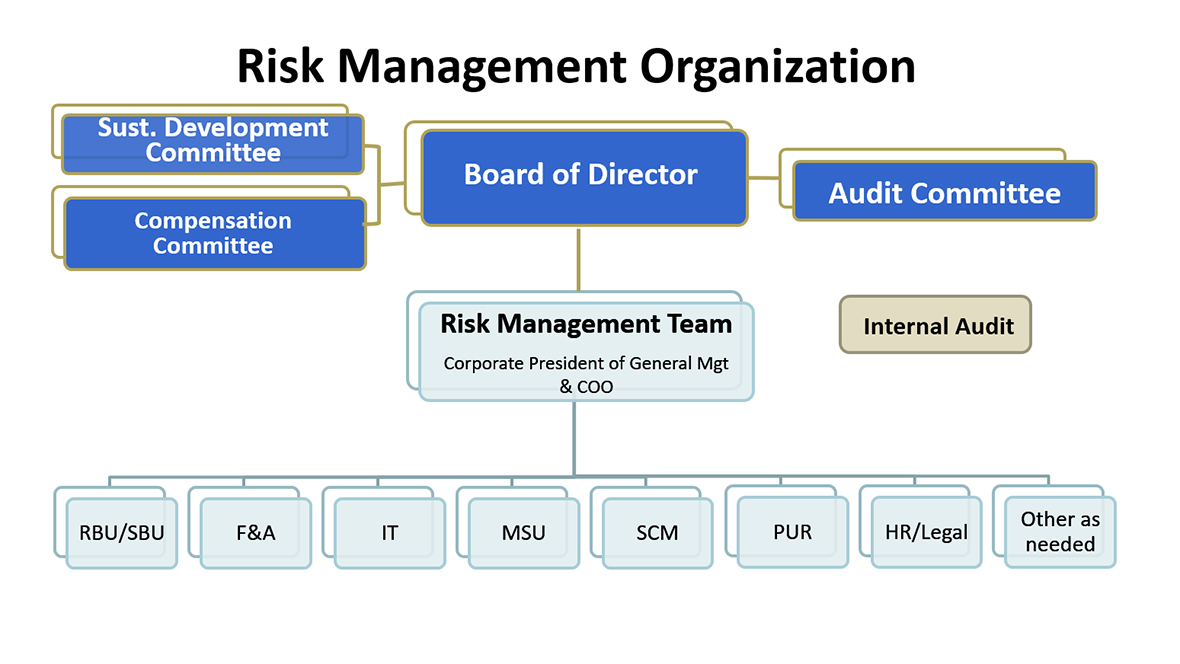

At end of 2020 Advantech re-examined risk management governance structure, risk management team composition and functions, risk management processes, to ensure risk management to be proceeded in a more systematic and structured manner. Board of directors is the highest governance entity for risk management, and directly supervise pan-strategic risks other risks like cyber security risk, Sustainable Development Committee and Compensation also supervise dedicated strategic risks, while Audit Committee is mainly responsible for supervising pan-operational risks.

Risk management team is responsible for implementing risk management processes and monitoring of risk mitigation actions quarterly, while function managers are responsible for formulating risk mitigation actions and actual execution. Internal Audit closely monitors and even assists to implement all risk management processes and provide suggestions, and performs audit on major risk subjects according to materiality and mitigation status each year.

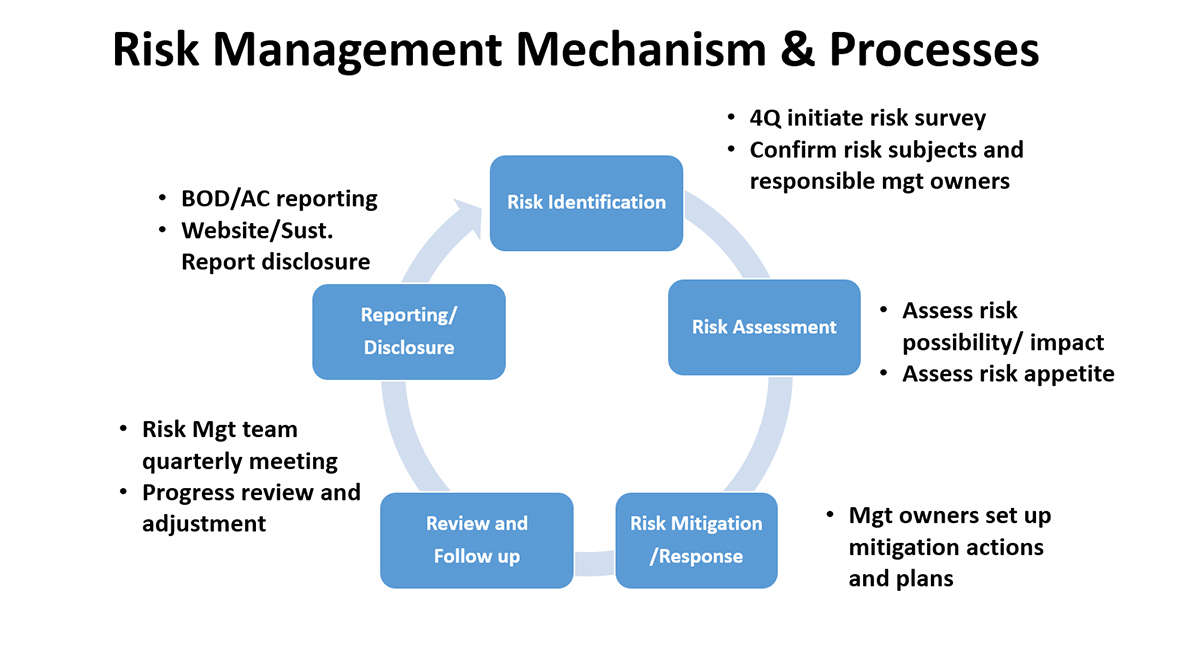

Advantech launches risk identification and assessment process in 4th quarter of each year, and will conclude risk management and mitigation plan in early next year. In light of quick changes of overall business environment, Risk Management Team and all management team will agilely observe and highlight changes of major risks, to add or adjust mitigation approach, and will include such agenda in quarterly risk management meeting and routine management meeting.

Board of Director (BOD) is the highest governance entity for risk management. Given the diversity of risk type and nature nowadays as well as different expertise required, the Company has divided governance role of major risks between BOD and Audit Committee according to risk type:

Board of Director (BOD): With dedicated role to govern the Company’s pan-strategic risks and global risks. BOD may assign selective risk to be reviewed in sub-committee but BOD shall take ultimate governance responsibility for those risks.

Audit Committee: With dedicated role to govern the Company’s pan-operational risks.

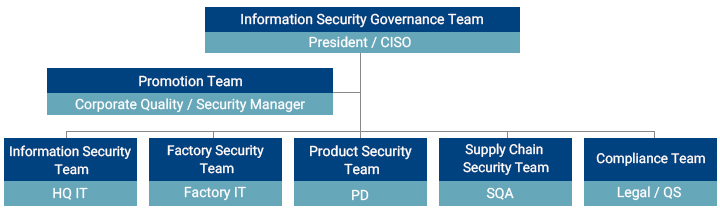

- A cross-departmental Information Security Governance Team is directed by the general manager of the company, which is promoted by the quality control and information security team, and coordinated information security issues of information technology, physical environment, product information, supply chain, and regulatory compliance.

- The Information Security Governance Meet is held every six months and regularly reports the progress to the Risk Management Committee.

Organization Chart of the Information Security Governance Team

- Information Security Team

-

- Planning the security strategy and guidelines for the company's overall information architecture.

- Establish and maintain the information security protection mechanism of the IT environment of the company.

- Notification and handling of IT information security incidents.

- Factory Security Team

-

- Plan and implement information security management procedures in the factory.

- Establish and maintain the company's OT environment information security protection mechanism.

- Notification and handling of OT information security incidents.

- Product Security Team

-

- Plan and implement various control measures in the product safety development life cycle.

- Respond to information security issues related to processing products.

- Supply Chain Security Team

-

- Identify information security risks in the production supply chain.

- Plan and implement various control measures for related risks.

- Supply Chain Security Team

-

- Identify information security risks in the production supply chain.

- Plan and implement various control measures for related risks.

- Compliance Team

-

- Assist and ensure that the company's operations and products meet the requirements of information security and privacy protection laws and regulations.